Starting up a business — piece of cake. Keeping it going past the first year … not so much. If you‘re like me, you’re an entrepreneurial spirit who wishes to have her cake (business) and eat it too (turn a healthy profit).

Unfortunately, it’s not always smooth sailing.

The small business owners I’ve seen succeed shared two traits: resilience and a willingness to learn and take action.

That second part is everything because the right attitude plus information is what helped me sustain my freelance business for the past 17 years. Sure, sometimes this isn’t enough to keep your doors open, especially when life happens, such as bad credit, pandemics, and market shifts.

But where there‘s a will, there’s a way (more so, if you have a cash cushion to see it through).

If you’re just revving up your business or considering starting one, knowing the startup challenges is key. It preps you for the bad, the ugly, and the worst.

So, let’s review what small business owners told me about their startup challenges and how they overcame them.

Table of Contents

Biggest Startup Challenges (According to Business Owners)

Learning from others‘ mistakes is one of the best ways to avoid them. So, let’s jump right into the top startup mishaps and tips to get past them.

1. Securing Funding

As a freelance writer, I didn’t have to worry about funding since all I needed was a laptop and the occasional hundreds (sometimes a thousand or so) to pay for courses and books. But folks going into ventures requiring inventory, real estate, and other tangibles don’t have it as easy.

In this case, it takes money to make money.

Sadly, the world works against the newcomers by requiring good credit and a year or two of being in operation. But how on earth do you establish credit rapport if it takes having established credit to get credit?

Then, you can forget about venture capitalists, who may also demand years of positive cash flow and profits to back your startup.

A vicious, unfair cycle.

And it’s the biggest problem most startups face. Based on a survey we conducted with entrepreneurs, we found that 54% struggle with earning and maintaining finances/money.

It breaks down into these sub-challenges:

- 22% can’t access funding.

- 19% have budget challenges.

- 13% want to but don’t earn recurring revenue.

The good news: There are better options out there today to help small business owners hop this hurdle. The bad news: Many come with predatory fees and terms that make borrowing loans seem so not worth it.

How to Overcome This

So, how are businesses faring against the challenges of securing funding?

“To get me off the ground, I borrowed some money from my family and took out a startup loan,” shares Jennifer Bailey, founder and CEO of Calla Shoes.

Bailey says she launched the business with just 35 thousand pounds.

“In the months leading up to the launch of my business, I joined a startup accelerator and got a contract for a new investment fund through that. The accelerator taught me how to do a pitch deck, financials, and also how to pitch, so I went into my first investment pitch day very confident,” Bailey says.

She secured a small amount of seed funding, which allowed her to give up her part-time job and focus full-time on Calla Shoes.

“My advice: Explore all funding avenues and try to make money from day one, especially if you have inventory,” continues Bailey. “Equity investment is necessary for most businesses, and you shouldn‘t go down this route unless you’ve researched where to get investments from and what type of business you want to have (e.g., build and sell a product or a lifestyle or legacy business).”

Others are using alternative funding sources, such as crowdfunding and angel investors, to start their businesses. Another alternative is to partner with someone who has funding.

“Our initial funding came in the way of a business partner,” explains Jennifer Johnson, founder of True Fashionistas. “She had the money, I had the brains, and we combined efforts.”

But be careful about this type of arrangement because if the funder leaves, so does your budget. After the funder left the partnership, Johnson notes that the business was financed with credit cards.

“In the long run, it was not so great and certainly not something I would recommend to others. It was expensive money, but it was the only way we had at the time to keep things moving. My advice would be to secure funding other than credit cards at the start. Perhaps with the Small Business Association or a bank in your area,” Johnson says.

Pro tip: Look into government grants for small business owners. It’s free money you never have to pay back and can be enough to give you a leg up. Search for local grants with your city, county, and state. And, check out Grants.gov to find federal grants for small business owners.

2. Building a Strong Team

Sometimes, going solo isn‘t the way to go. You need a team behind you to make your engine operate efficiently. I’m talking about folks who can handle the day-to-day tasks, so you can focus on the big picture.

For example, you may hire:

- Marketer to get word out about your business.

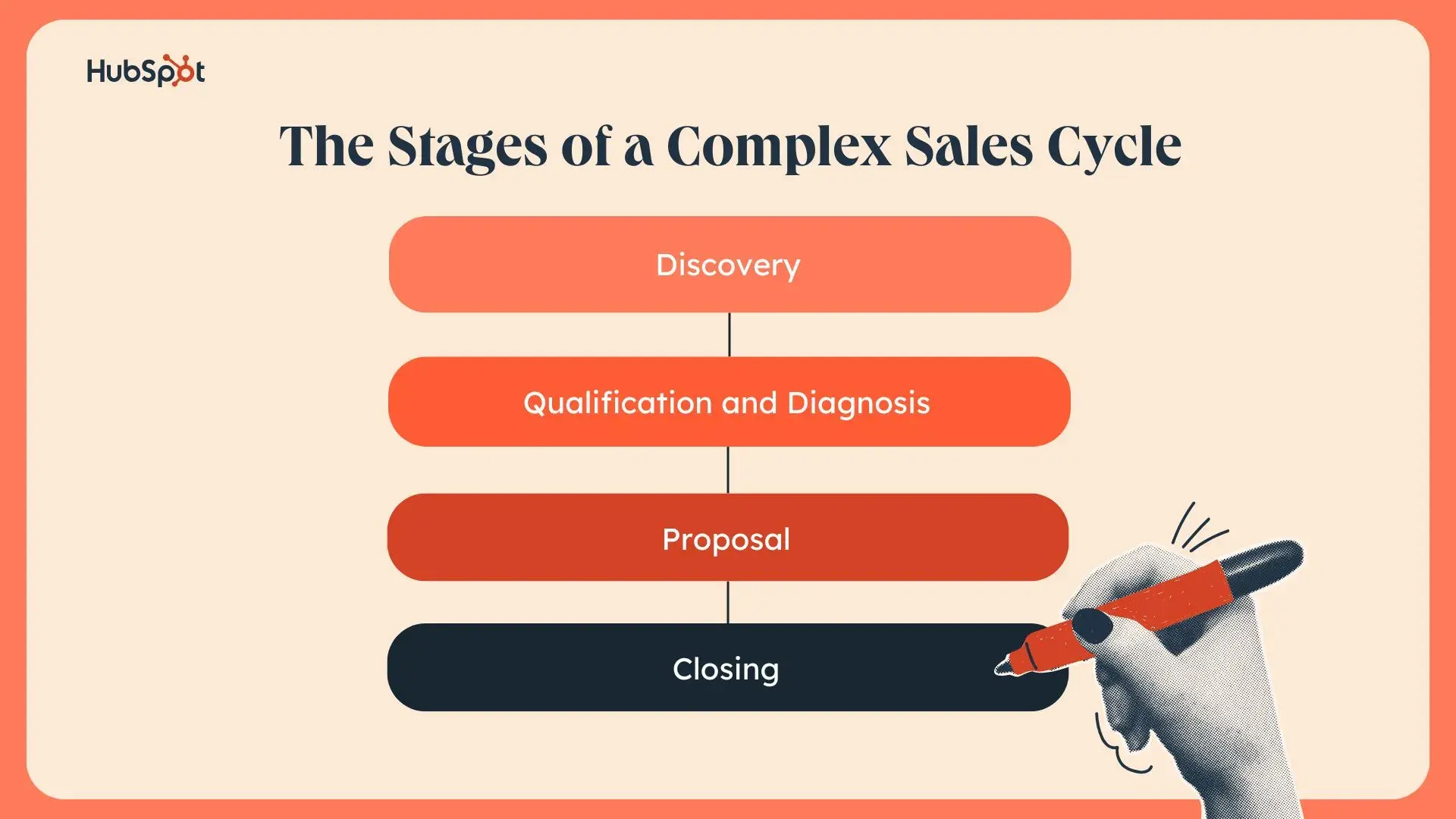

- Salesperson to convert leads into buyers.

- Virtual assistant to schedule your appointments.

- Manager to oversee operations and inventory levels.

Then, you can continue finding ways to grow and expand your company. But this costs money (hopefully, you’ve got the funding part taken care of) and requires hiring the right people.

This takes time and could lead to many mistakes, especially when you hire too quickly or for the wrong reasons.

How to Overcome This

Outsourcing is the only way to scale in my business, so I had to learn systems and processes. I needed to document how I do things to teach others how to do the same without looking over their shoulders. So, the sooner you document all of your processes, the sooner you can bring people on board and run a smooth operation.

But even after you have your documents in order, you still have to find and convince the right talent to join you.

“If you want great employees to join your team, give them the power to lead,” advises Darryl Stevens, CEO of DIGITECH Web Design. “One of the biggest advantages of joining a startup is the ability to flex your decision-making muscles and help build something from the ground up.”

If you have problems offering the best salary, you can compensate in several ways.

“Attracting and retaining top talent was challenging because of limited resources,” continues Stevens. “We focused on creating a positive and inclusive company culture where employees felt valued and had growth opportunities.”

Stevens notes that offering flexible working hours, professional development opportunities, and a collaborative environment helps the company attract and retain employees. “We also implemented an employee referral program, which brought in skilled candidates through trusted recommendations,” Stevens says.

Pro tip: No need to start with full-time employees. Look for contractors to outsource to and pay them based on the deliverable or project. This way, you can adjust your budget monthly based on the ups and downs of your startup.

3. Dealing With Imposter Syndrome and Gaining Credibility

You’ve just opened your doors, offering a service. How can you prove to new clients that they should invest in you? As a freelancer, my skills are my product and it was tough getting good clients (emphasis on good) to hire me.

That’s because they all demanded a portfolio in their industry, preferably published with known companies.

Imposter syndrome is real when you lack the experience, background, and client list to prove your worth. But everyone has to start from somewhere.

How to Overcome This

As a content writer, I used marketplaces that big companies used to work with freelancers (Clearvoice and NDash) to build my portfolio and credibility. Then, once I got five samples, I added them to my website and started pitching myself to bigger brands (like HubSpot).

Whatever type of business you start, you must go after your industry’s low-hanging fruit. That may be selling products that you know folks will buy just to get them to your site to check out the real products you really want to sell. Another option is to offer coupons in exchange for emails (to send promotional emails).

Or, if you‘re a service provider, you can offer a cheaper rate or even do pro bono work just to create samples for your portfolio. Since you don’t have the capital, you can use sweat equity to build your business credibility.

Darryl Stevens says the most significant challenge he faced was establishing credibility in a crowded market. “As a new entrant, convincing potential clients to trust our services was tough,” shares Stevens.

To overcome this, Stevens focused on building a strong portfolio by offering pro bono work to local businesses and non-profits.

“This provided us with case studies and testimonials and helped build a network of referrals. Additionally, I made it a point to personally meet with clients, ensuring that they felt valued and understood,” Stevens says.

It also helps to have a clear, compelling brand message that speaks to a specific target. Don‘t be a Jack or Jill of all trades. Be a master of one or two that solve your customers’ biggest frustrations.

This will help those who visit your site understand that you’re the right business for them. It will also help with word-of-mouth referrals from past customers. They know exactly what you do and will think of you as a go-to for the product or service you provide.

Pro tip: As you grow your client and customer list, ask for reviews and testimonials soon after they buy from you. Place the feedback on your website, social posts, and other marketing materials to sell your credibility and land more business.

Source

4. Scaling Operations

When you start a business, you‘re eager to grow it quickly. This is true whether you’re a freelancer looking to land bigger contracts, an ecommerce store wanting to sell more goods, or a local service provider desiring an expansion to neighboring cities.

But from my experience, scaling requires excellent organization (e.g., those documented processes) and a thought-out plan to scale (who you’ll hire and why). You need people and capital to make this work, otherwise you may scale faster than you can keep up with.

I’ve seen this happen with small agencies that landed big deals but couldn’t fulfill the demand because they lacked the freelance talent to pull it off.

How to Overcome This

If you’re looking to scale fast, pre-vet help and have them on standby. Also, get the proper tools, such as a CRM, sales software, project management platform, and accounting software (or other industry-related software that’ll streamline your workflows).

In my business, I use Perplexity to speed up my research process, Grammarly to help with editing, Slack to keep in touch with clients, and Trello to manage all my projects.

But again, without the people to hire or outsource to, you’re only able to scale so far.

“A major setback I experienced was the initial difficulty in scaling my services,” says Tilda Whitaker-Bailey, known as The Coach’s Mentor.

Whitaker-Bailey says she realized that her time and reach were limited with one-on-one coaching. “To overcome this, I developed scalable offerings like online courses and group coaching sessions. This helped me reach a wider audience and diversify my revenue streams, ensuring more stability and growth,” she says.

Pro tip: If you decide to scale, ensure quality is never compromised. One of the challenges I faced was bringing on editors and writers who delivered poor-quality work, which meant I had to sacrifice time to do it myself or more money to pay someone else to fix it.

5. Navigating Regulatory Compliance

Regulatory compliance is an issue for those in industries with strict laws. For instance, finance, medicine, telecommunications, transportation, environment, energy, and food and agriculture. I also see ecommerce regulations becoming more stringent, revolving around consumer protection, data privacy, taxation, competition laws, and shipping and logistics.

Keeping on top of the latest rules in your industry is critical to avoid fines and penalties, or worse, having your business sued or shut down.

How to Overcome This

There’s only one way to truly avoid legal trouble: having the right legal counsel.

Stevens says navigating regulatory and compliance issues requires thorough research and professional advice.

“We consulted with legal and financial advisors to ensure we met all local, state, and federal requirements. Implementing a compliance management system helped us to track necessary filings, permits, and licenses. Staying informed about regulation changes and maintaining good relationships with regulatory bodies were essential practices,” he advises.

Source

Pro tip: Research your industry and learn the latest regulations before starting your business. Make sure you have the money to pay the right professionals to help you stay legally compliant.

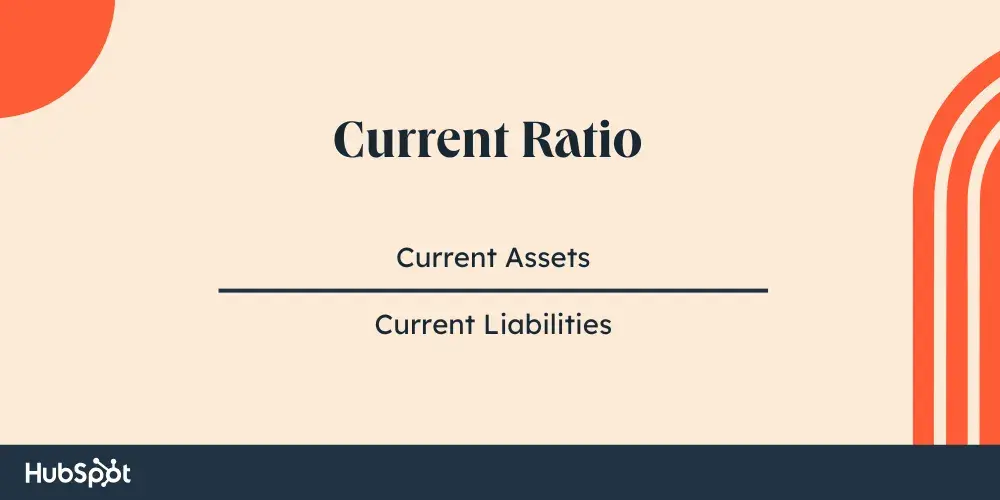

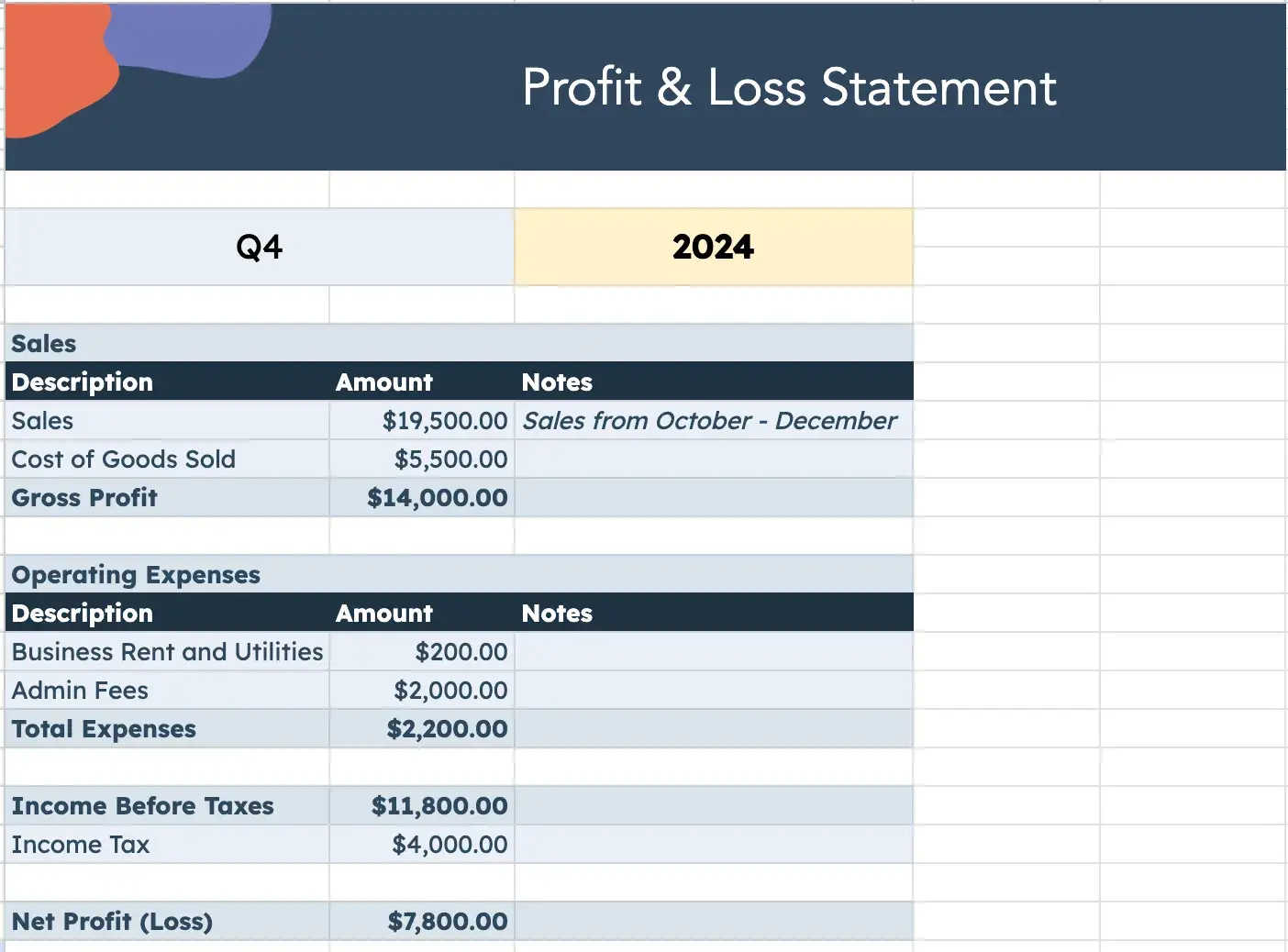

6. Managing Cash Flow

Your business is finally making money, and now you need to make sure every penny is accounted for and invested in the right areas of your company. It’s easy for money to get lost without the right tools. This is why I recommend using accounting software to track the flow of money and the performance of your business.

For instance, I use Bonsai to invoice clients, track revenue, and tag expenses. It even helps me to determine how much I should pay in quarterly taxes. It’s a guesstimate but better than owing $XX,000 during tax time.

When you don‘t manage your cash flow, you risk going into debt. Or misallocating your dollars towards everything but business growth (e.g., excessive marketing to the wrong audience or luxury office expenses). If you’re taking every cent to fund a lifestyle or aren‘t earning enough beyond paying your team, it’s time to find ways to grow revenue or decrease expenses.

How to Overcome This

If you’re super organized, then you may not need fancy software. You can use spreadsheets and manually enter the data yourself or hire a bookkeeper to do it for you.

“I used spreadsheets which I constantly updated and looked at,” shares Bailey of Calla Shoes. “I found it hard, I’m not going to lie!”

Bailey says she struggled with managing cash and inventory. Ecommerce stores don’t know what top items will be in advance of selling. Further, with shoes, you’re managing different styles and sizes. When tackling these challenges, Bailey turned to a friend in the industry.

“One of my shoe business friends has a great model for getting going, which was creating her community on Instagram, only buying a relatively small amount, building lots of excitement up to the launch of a new style, and then selling out pretty much straight away. If a style really worked, she would buy more of them. It meant she wasn’t stuck with loads of shoes and cash tied up in stock,” Bailey says.

Source

This is an excellent way to test the market before you invest in a product. But if you’re looking for a way to go deeper with tools and processes, you can use these tips from Stevens.

“We used detailed budgeting and forecasting to track expenses and revenues closely,” continues Stevens. “Invoicing promptly and following up on late payments helped maintain steady cash flow. Additionally, we adopted cloud-based accounting software, which provided real-time financial insights … Maintaining a lean operation focused on essential expenditures allowed us to manage cash flow effectively.”

Other ways to fix cash flow issues are to:

- Develop detailed financial projections.

- Implement strict budgeting and expense tracking.

- Consider invoice factoring or lines of credit.

Pro tip: If your cash flow issues are due to clients’ late payments, negotiate payment terms in advance (or request payments upfront before providing a product or service). You can also offer discounts to encourage customers to pay on time (e.g., 10% off if they pay Net 15 instead of Net 30).

7. Adapting to Market Changes

I never witnessed a major market shift in my lifetime like the one we experienced during the pandemic. It forced almost every industry to make major changes quickly, whether it was going remote, switching suppliers, or drastically changing operations.

For instance, we saw platforms like Instacart thrive when no one visited grocery stores. And, some empty office buildings reimagined their spaces into warehouses to accommodate the rise in ecommerce and make up for revenue loss during the shift towards remote work.

If there‘s one lesson learned, it’s that market changes can happen anytime and drastically. While we can’t prepare for every possible scenario, we can try to remain agile to sway with the waves.

“Our biggest pivotal moment in the business was certainly COVID. We were forced to close our store for two months,” says Johnson. “However, it was during this time I had a few real revelations and brought the business to new levels. My first revelation was that we needed to be more diverse as a business in how we got our product in front of our customers.”

Since they had to be physically closed, they had to figure out how to reach their customers beyond their website.

“I decided to start selling live on Facebook,” continues Johnson. “The one issue was that I was so upset and anxious about going into the store because I knew if customers showed up at the door, I couldn’t let them in. My husband went to the store every day to get the product and brought it to our home so I could do the live shows from there. It was what saved our business. We continue to do these live shows to this day.”

How to Overcome This

Pivoting your business at a moment‘s notice isn’t always feasible. However, if you pay attention to market trends and customer feedback, you can get a taste of a major shift that’s coming.

For example, AI is drastically transforming the marketing industry. I’ve seen some writers pivot to being AI editors, who generate content with AI tools and then edit it to sound human. Others are leaving writing altogether to become content strategists.

There are plenty of writing opportunities still out there, but seeing the future as it shifts prepares you to adapt before it becomes necessary. And the businesses that notice these trends (and act upon them) will have a leg up in the market in the future.

So keep your entire palm on the pulse to notice any and all changes as they happen, so you can decide when it’s time to pivot.

Some pivots will be small, others more drastic. Here are several examples of companies that made the right move at the right time:

- Instagram pivoting from a check-in app to a photo-sharing platform.

- Slack evolving from a gaming company to a workplace communication tool.

- YouTube shifting from a video dating site to a video-sharing platform (news to me!).

Pro tip: Don’t be afraid to venture into different industries and markets. I went from talking solely about digital marketing to writing for SaaS brands in finance, HR, and ecommerce. Also, continue to upskill yourself and your team to be prepared for these potential shifts.

Great upskilling areas include leadership, digital marketing, sales, data analysis, financial management, strategic planning, and tech skills. I’ve upskilled with books and online courses on digital marketing, editing, and content strategy, so it doesn’t have to be expensive!

8. Beating the Competition

Some markets are saturated with competitors, and others have major brands that seem impossible to beat. When you enter the field as a startup, your first thought is, “How am I going to stand out and get customers?”

Then, once you become an established brand and have to deal with new entrants, you‘ll also question how you’ll remain relevant.

In either scenario, you’re battling with visibility and brand awareness. Thanks to technology and the web, achieving both is easier and more affordable for startups than ever before.

How to Overcome This

“Beating the competition” is a great goal. But if you ask me, it‘s the wrong mindset, especially for a startup. Your initial goal isn’t to take out the competitors. Instead, focus on how to separate yourself from the competitors to stand out and win customers looking for what you offer specifically.

For instance, there are hundreds of project management apps on the market. Notion chose to stand out by becoming an “AI-powered workspace.” This is a nice strategy newcomers can use to stand out in highly competitive industries.

Source

The perfect time to enter a market is when there’s a big shift, and top players haven’t adapted yet. So, always look for trends and gaps when building your startup.

Sparktoro is an excellent example of a startup filling a gap in the crowded digital marketing industry. It focuses on a major marketer pain point — getting up-to-date insights about customers (e.g., who they follow, what they’re talking about, which publications they read, etc.).

If you find a demand that isn‘t being fulfilled well or at all, you’ll be in the money faster.

Other ways you can differentiate your startup include:

- Focusing on unique selling points and niche markets.

- Continuously improving products/services based on customer feedback.

- Building strong customer relationships and brand loyalty.

Pro tip: Conduct market research by going straight to the customer. Interview and survey your target audience to learn what they don’t like about current solutions they use and find patterns. Use this to create your product or service to stand out to customers looking for a better way to do X and Y.

9. Marketing on a Budget

Reaching your target audience when your budget is limited can be challenging. Low funds make it impossible to advertise consistently and push out content to gain awareness. Startups lack the capital and the team to do what the giants do, so they quit before even starting.

When you fail to market your startup, you increase your odds of never gaining traction to keep your business open.

Unfortunately, many new business owners are unaware of the tools, platforms, and strategies available to them. So, they struggle to spread the word about their offer and turn a profit.

How to Overcome This

I feel there‘s no excuse not to learn marketing today. There’s “YouTube University” that‘s free to watch and learn from brands giving away gems businesses can use to grow. And then there’s HubSpot Academy, which I’ve gained more than a few certificates from to stay ahead of the marketing game.

You can learn everything from social media marketing and search engine optimization to email marketing and branding. The knowledge is there for the taking. You just have to take the time to … well, take it.

Create a lead generation funnel to drive folks from these channels into your sales pipeline. Begin with freelancers to build your content strategy, write several monthly posts, and manage your social media accounts daily.

For example, your blog and social media posts will direct leads to a downloadable guide or tutorial, which captures their email address. Then, you can enter them into your CRM and email marketing campaign to nurture them into scheduling a call or demo.

Then, your team (or you) take it from there.

If you’re selling products, I recommend investing in ads early on and using social media marketing. The trick is getting as much visibility as possible from low-cost channels.

Here are several ideas you can try right out of the gate:

- Focus on cost-effective digital marketing strategies (email marketing, social marketing, content marketing).

- Use data analytics (Google Analytics and Google Search Console) to optimize marketing efforts to improve traffic and conversions.

- Hire freelancers to save money on labor costs.

Pro tip: If you can invest in influencers, go for smaller ones (nano- and micro-influencers) with higher engagement. Their audiences are more likely to try product and service recommendations from influencers who feel real (versus celebrities who don’t take the time to respond to the comments).

10. Maintaining a Work-Life Balance

Startup life and balance rarely go hand in hand. You‘re in hustle mode and can’t stop until you feel you‘ve made it. The problem is that startup business owners have a hard time identifying success. There’s always a bigger fish to catch, putting them on an endless hamster wheel.

The drive is great, but making room for your personal life is vital. The last thing you want is to divorce or break up, miss precious moments with children, or fall out with friends and family because you overwork. Then there’s the health factor — burnout is a real condition many of us (including me) have suffered from.

Source

It can hurt your productivity and cause serious damage to your body (and your business).

Many people ask how to create a work-life balance to ensure their business continues to grow, and their personal lives thrive.

How to Overcome This

There‘s only so much you can accomplish as a solopreneur. If you don’t have a team in place, the odds of burning out increase exponentially.

“Entrepreneur burnout is one of the biggest problems that can kill a small business,” says Mark Pierce, Wyoming Trust & LLC Attorney. “When you have created a business from scratch, letting go and allowing others to help you is hard.”

If anyone understands burnout, it’s law practices.

But to combat it, you must learn to delegate (this is where those documented processes will come into play). You can use documentation and video training to bring on others without having to be too involved.

If you can afford a manager to oversee hiring, onboarding, and day-to-day operations, then do it ASAP. Your future self will love you.

The only other way to avoid burnout is to slow down (but who wants that?). No, but seriously, sometimes too much scaling is bad. I’ve seen agencies grow to seven-figure businesses but end up turning a mediocre salary for themselves. To me, it’s not worth scaling and working overboard only to lose more money than I’m making because I have too many people and services to pay.

So, ask yourself regularly whether growing more is necessary or if you’re financially comfortable.

Here are other ways to maintain a good work-life balance:

- Set clear boundaries between work and personal life.

- Delegate tasks and build a support network.

- Prioritize self-care and stress management.

Pro tip: Use tools to manage your time. I use the Pomodoro method (using an app I downloaded on Windows). Make a schedule that‘s feasible and stick to it. When it’s time to get off, push things to the next day and adjust your schedule accordingly. Always give yourself enough time to complete tasks and include break times throughout the day.

11. Not Taking Networking Seriously

One thing I‘ve learned as an entrepreneur is that you never know where your next customer is coming from. Sometimes, one comes from a surprising place. For instance, someone you’ve connected with online may gain interest in your offer or refer a client to you.

It makes connecting and networking worthwhile (outside of gaining valuable friendships).

Networking comes with many benefits, especially when the individual is in the same or similar industry. For instance, they can offer advice, give you the hookup to a conference, or introduce you to someone who can offer business partnerships and opportunities.

“In the early days of Ondato, we realized that having a great idea and a solid business plan wasn’t enough,” shares Liudas Kanapienis, CEO of Ondato. “We needed to connect with the right people. I started attending every FinTech conference, seminar, and networking event I could find. At one of these events, I met a potential investor who seemed genuinely interested in what we were doing.”

Instead of diving straight into a pitch, he focused on building a relationship.

“Over the next few months, we had several informal meetings — coffee chats, lunches, and discussions about industry trends,” continues Kanapienis. “I made it a point to share our progress, early wins, and how we were overcoming challenges. This transparency and consistent communication built trust and rapport.”

One day, during a casual meeting, this investor asked detailed questions about their product and market potential.

“It became clear that our relationship had grown beyond just casual interest. They saw our passion, commitment, and the potential impact of our solutions. After months of building this relationship, the investor decided to back Ondato, providing not just capital but also invaluable advice and connections,” says Kanapienis.

Unfortunately, many startup founders view other business owners in their industry as competitors or don‘t see the value in networking with them. Those who view networking as a meal ticket may treat every person as a prospect, and that’s a major turnoff.

How to Overcome This

Once you understand the various benefits of networking, you‘ll never stop building yours. The stronger your network, the more value it brings to you and vice versa. So make sure you’re giving just as much as you’re receiving, if not more.

I can say that networking was the key to helping me get bigger and better clients. These individuals are my referral hub, and I consistently refer work to them as well.

If you’re interested in building your network, then you can:

- Attend industry events and conferences regularly.

- Join professional organizations and online communities.

- Develop a strategic approach to building and maintaining relationships.

- Leverage social media platforms for professional networking.

Source

Pro tip: LinkedIn is a great place to find your tribe. Search for groups that can benefit your business, such as those in marketing, finance, startups, accounting, or your industry.

12. Not Using Mentors

There‘s a lot to learn when you first start a business. Some you’ll learn along your journey, which I call the hard way. If there‘s an opportunity for me to learn from others’ mistakes and knowledge, I prefer this route to avoid a downfall.

Sure, you can read articles like this to provide insights into what other startups have done during a challenge. But there’s nothing like having a person you can talk to any time to get your questions answered. It can save you the heartache of making the wrong tax mistakes, growing too fast, or entering a bad deal.

I‘ve found myself on both sides of the coin. I have mentors I talk to, and I offer mentorship to up-and-coming writers in my niche. I’ve personally seen my mentees grow their skills and income drastically, which is delightful.

The downside of mentorships is that they‘re not always free. Some charge per call, hourly, or on a retainer basis. But it’s worth every penny for the right one.

How to Overcome This

The first step is to ask others you already know about mentors they recommend. Or maybe someone in your network is more knowledgeable and successful than you who can become your mentor.

You can also do a quick LinkedIn search for coaches and mentors in your niche. However, if you’re more outgoing, then you can find them at events.

Stevens notes that mentorship and networking were invaluable. Early on, Stevens connected with a mentor through a local business association who provided guidance on strategic planning and scaling the business.

“Attending industry conferences and local networking events helped build relationships that led to new clients and partnerships. One specific example was a networking event where I met a marketing expert who later became a strategic partner, helping us expand our digital marketing services,” Stevens says.

To make mentorship work for you:

- Actively seek experienced entrepreneurs or industry experts as mentors.

- Participate in mentorship programs or accelerators.

- Be open to feedback and willing to learn from others’ experiences.

- Cultivate relationships with multiple mentors for diverse perspectives.

Pro tip: Consistently put yourself in places where you’re not the smartest or most successful person in the room. This way, every conversation and introduction is with someone who can drop gems regarding your business venture.

Overcoming Startup Obstacles

After running a business for nearly two decades and speaking to other small business owners, I find that the biggest takeaway is to grow your network. Your network can lead to you getting funding, overcoming (or preventing) challenges, finding mentorship, and receiving referrals for talent or client/customer opportunities.

So, if you’re looking to start and grow your business, begin networking as quickly as possible. It can save you a lot of time, money, and disappointment down the road.

And for words of encouragement: The first year may be a tough one, but our survey shows that 42% of entrepreneurs were profitable by the beginning of year two.

![]()